Retailers Adapt Traditional Footprint To Accommodate Curbside Pickup

U.S. consumers spent more than $861 billion online in 2020, as the COVID-19 pandemic spread, according to Digital Commerce 360. That represents a 44% year-over-year jump and the highest annual U.S. e-commerce growth in 20 years. Part of that growth was driven by shoppers’ desire to avoid entering brick-and-mortar stores, preferring instead to pick up their orders curbside shortly after placing them online. As it turns out, handling that uptick in in-store fulfillment has proven to be every bit as challenging to retailers as managing the tremendous upswing in direct-to-consumer parcel shipments from distribution centers.

To address the difficulties associated with filling orders directly from store shelves — including limited back-of-store space, an increase in employee traffic in the aisles as they pick products to fill orders (which traditional shoppers find frustrating), and rapid stock-outs of inventory — more retailers are reconsidering their traditional brick-and-mortar footprint. A recent article in MHI Solutions magazine, “Rethinking Retail Stores’ Footprint in the Age of Curbside Pickup,” produced by MHI’s Solutions Community, discussed how retailers are automation at the store level to satisfy the increase in demand for curbside convenience.

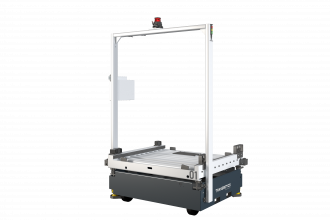

Although many states have reopened and stores are once again operating normally, many consumers have come to embrace the advantages of not having to enter a store, spending time searching for items, or waiting in line to check-out. Nearly every major retailer, both big box and grocery, has begun to assess — and even to implement — micro-fulfillment centers (MFCs) that leverage goods-to-person automated storage and retrieval systems (ASRS) or autonomous mobile robots (AMRs).

For some retailers, adding automation to the back of the store requires expanding that space at the expense of the retail floor footprint; conversely, others are leveraging highly dense ASRS solutions that maximize the available cube of the back room, enabling even more product to be offered in the front of the store. Determining which approach is best for a storefront requires consideration of the peak factor, that is, designing the system to accommodate the busiest days, times of day, and seasonality. This is particularly important for retailers who promise in-store pickup within two to four hours after placing an order so as to meet customers’ expectations.

Additionally, with the implementation of automated solutions at the retail store level, omni-channel retailers can leverage their network-wide inventory and order management systems to fill orders from the location that is closest to a customer. For example, an online order historically fulfilled from a centralized distribution center can instead be routed for fulfillment to a store in closer proximity to the customer’s geographic location. This not only reduces the shipping time, but it also reduces the shipment cost as the delivery distance is shorter.

For more details about how retailers are leveraging automated solutions to address customers’ online shopping expectations, read the full article here.

Solutions Community members are the industry’s thought leaders on automation, software, hardware, equipment and services that support a fully integrated supply chain. This includes suppliers, integrators, consultants, media, academia and users. They collaborate on solutions worldwide and in virtually every major manufacturing and distribution sector.